Inspectors General are generally responsible for annually auditing the financial statements for their respective agencies. The Financial Report is compiled primarily from individual federal agencies' audited financial statements and related information included in the agencies' financial reports. The Government Accountability Office (GAO) is required to audit these statements.

The Department of the Treasury, in coordination with the Office of Management and Budget (OMB), prepares the Financial Report, which includes the financial statements for the U.S. The Financial Report also discusses important financial issues and significant conditions that may affect future operations, including the need to achieve fiscal sustainability over the medium and long term. The Financial Report of the United States Government (Financial Report) provides the President, Congress, and the American people with a comprehensive view of the federal government's finances, i.e., its financial position and condition, revenues and costs, assets and liabilities, and other obligations and commitments. Please enable JavaScript to use all features.įinancial Report of the United States Government (These levies are split between employer and employee.)īut the government also raises money in other ways, including charging admission to national parks, levying customs duties on foreign imports and exports and imposing excise taxes on items such as alcohol, tobacco and gasoline.Some features of this site will not work with JavaScript disabled. The next biggest slice comes from Social Security and Medicare payroll taxes of 12.4% and 2.9%, respectively. The largest chunk of revenue, by far, comes from individual income taxes - which amounted to more than half of the money collected in the last fiscal year. The shortfall is the budget deficit for that year and adds to the total national debt. The federal government collected $4.9 trillion in revenue in fiscal year 2022, about $1.38 trillion less than what it spent, according to the Treasury Department. Sources: US Treasury Department, Center on Budget and Policy Priorities Note: Percentages do not add up to 100 due to rounding. Peterson Foundation.Ĭovers veterans benefits and services, transportation, general government services, the Internal Revenue Service and federal law enforcement, corrections and the judiciary, among other things. Interest costs are expected to balloon further in coming years, exceeding federal spending on Medicaid and defense within a decade, according to the Peter G. More than half of this funding goes toward national defense, while the rest supports a wide variety of federal agencies and programs, including education, transportation, housing, environmental protection and federal law enforcement.Īnd then there’s interest owed on the debt, which has grown rapidly over the past year amid repeated rate hikes by the Federal Reserve. Lawmakers, however, do have control over so-called discretionary spending, which they vote on annually.

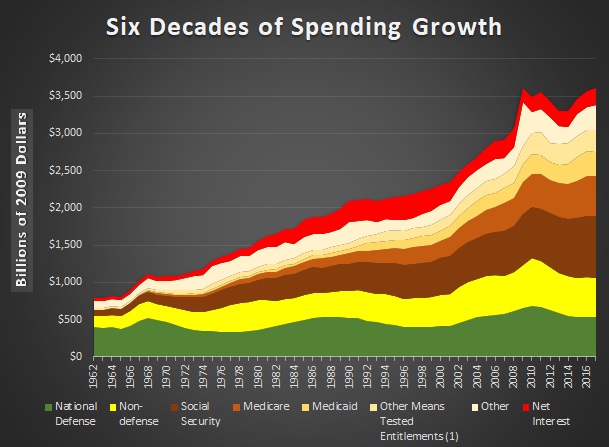

Congress does not specify funding levels for these programs annually. Social Security, Medicare, Medicaid, food stamps, veterans benefits and retirement programs for federal civilian and military retirees all fall into this category. Nearly two-thirds of annual federal spending is what’s known as mandatory spending, which means existing laws require the funds to be allocated. The federal government spent $6.27 trillion in fiscal year 2022, which ended last September, according to the Treasury Department. The US federal debt in inflation-adjusted dollars has increased from $408 billion in fiscal year 1922 to more than $30 trillion today.Ĭredit: Curt Merrill and Matt Stiles, CNN Biden has said his budget proposal, which he is expected to unveil on Thursday, will seek to reduce the deficit by $2 trillion over 10 years. President Joe Biden and House Republicans are locked in a battle over whether to pair addressing the debt ceiling with cutting spending.

Wars, economic downturns and the Covid-19 pandemic have caused the debt to balloon over the centuries. In fact, the US has been in debt since its inception, according to the Treasury Department. The nation’s fiscal imbalance is nothing new.

In the last 50 years, the government has only run a surplus five times, most recently in fiscal year 2001, according to the Treasury Department. The debt is an accumulation of those deficits. The debt stems from the federal government spending more than it collects in revenue, which results in an annual deficit. A default would have catastrophic consequences on the nation’s economy, global finances and many Americans. This staggering amount is in the spotlight because the federal government has hit its borrowing cap and will not be able to pay all its bills within a few months if Congress doesn’t act. (CNN) - The US is $31.4 trillion in debt.

0 kommentar(er)

0 kommentar(er)